Nvidia’s recent stock split, despite making headlines, is more of a superficial change rather than a substantial shift in the company’s value or operations. The split, which came into effect after Friday’s market close, saw Nvidia’s stock multiply tenfold. However, experts argue that this alteration won’t significantly impact Nvidia’s massive $3 trillion valuation or its underlying business fundamentals, which have consistently attracted investors.

Paul Meeks, a seasoned tech investor and professor at The Citadel, notes that stock splits like this primarily serve cosmetic purposes, especially for existing shareholders. Nvidia, being cognizant of investor expectations, continues to engage in practices to maintain investor interest, despite the split having little material effect.

Nvidia’s meteoric rise over the past five years, with a staggering 3,174% increase in stock value and a 218% surge in the past year alone, underscores its dominance in the AI landscape. This surge has propelled Nvidia’s market cap beyond giants like Amazon and Alphabet. Before the split, Nvidia’s stock price stood at a formidable $1,209, possibly deterring retail investors. Humayun Sheikh, CEO of Fetch.ai, a startup focusing on AI developer tools, believes the split aims to make Nvidia shares more accessible to a wider investor base, thus enhancing its attractiveness.

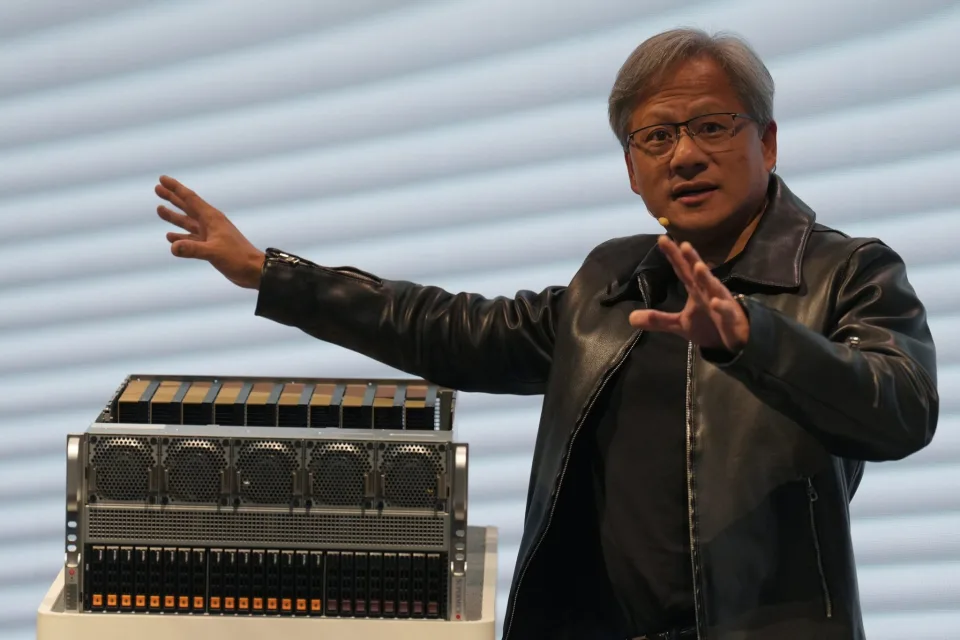

While the split may influence perceptions and potentially accelerate market cap gains, Nvidia’s position as a leader in providing AI infrastructure remains unchanged. The company’s impressive first-quarter sales of $26 billion, a 262% annual increase, have surpassed even optimistic Wall Street projections.

This surge in Nvidia’s stock value also reflects broader trends in the AI sector. Vasant Dhar, a professor at NYU’s business school, suggests that Nvidia’s performance mirrors the growing importance of AI as a transformative technology akin to the internet or electricity, with significant implications for economic productivity.

However, despite the optimism surrounding Nvidia, some investors remain cautious about potential risks post-split. Meeks highlights an economy-wide slowdown as a possible obstacle, though he believes such an outcome is improbable given expectations of U.S. economic resilience and potential Federal Reserve interventions. Conversely, Sheikh identifies retail investors as a potential concern, citing their collective influence on stock prices, as seen in recent market events like the GameStop saga.

While the split may attract a new cohort of retail investors, Sheikh warns of the flip side, where negative sentiment or speculative trading could adversely affect Nvidia’s stock price. Nonetheless, Dhar emphasizes that any impact from the split would pale in comparison to the broader market forces driving Nvidia’s performance.

In essence, Nvidia’s stock split may offer cosmetic changes, but its underlying strength and market dominance in AI continue to underpin its long-term growth prospects.